Ensure Financial Success

With kickoff of the inaugural MACRA reporting period upon us, many healthcare providers will greet 2017 with quality payment program objectives top-of-mind. The new pay-for-performance reimbursement landscape will usher in the adoption of new clinical and technical workflows as physicians work to meet the goal of driving better patient outcomes through smarter healthcare resource utilization. The cornerstone of these initiatives, however, is an effective financial strategy.

As providers gear up for reporting under MIPS and other quality payment models, assessing financial infrastructure before layering in payment program initiatives ensures future plans are built on a solid foundation. By cementing effective revenue cycle management practices up front, practices can be confident their organization is securing all financial resources available, which may serve the organization elsewhere in the push to value-based care.

Optimize Your Revenue Cycle Today

Stabilizing and optimizing existing revenue streams to ensure the practice isn’t leaving “money on the table” is a fundamental and often overlooked element of any practice strategy. Regardless of the path you elect to pursue under MACRA’s quality payment program, renewed emphasis on the following key areas can garner more revenue for your organization starting today.

- Coding:Ensure accurate coding, documentation support and audit practices to optimize revenue and to prevent rejections, denials and audits. These best practices can add 2%-10%+ revenue alone.

- Denials:“White glove” claims prep work on the front-end coupled with strong appeals practices on the back-end end can help plug revenue leaks and add 1%-3% increased cash flow.

- Contracts:Providers should analyze contracts and scrutinize payer reimbursements every 6-12 months to ensure revenue due to the practice is collected.

Tap into New Revenue Opportunities under MACRA

Once core revenue cycle management (or I call it revenue cycle performance) practices are solidified, it’s important to understand key performance indicators, trending and the cost of operations before heading into QPP participation. Look for any new earnings opportunities that may benefit the practice moving forward.

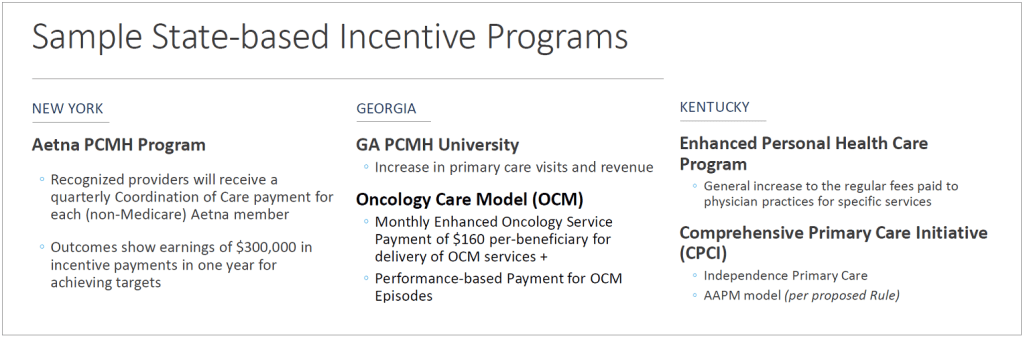

- Incentive Options:Reach out to commercial payers to evaluate any value- and risk-based contracts your practice may qualify for. Take advantage of plan- and state-based incentive programs that may not be advertised.

- Practice Support:Does your practice qualify for funds set aside to help small and rural practices? The MACRA final rule provisions $20 million each year for five years to fund training and education for small practices of 15 or fewer clinicians and practices in rural areas.

- Focus on the Right Measures:Identify quality metrics that your practice has a proven success record with to alleviate reporting burdens and maximize revenue opportunities under MACRA.

- At-Risk Partners:Many providers will turn to outside expertise to facilitate participation and reporting under MACRA and the quality payment program. Look for partners who will go at-risk with you to make sure maximum ROI is seen.

Set Your Practice Apart Moving Forward

As you work to hit all the right points from a reporting perspective under the QPP, make sure you don’t neglect the business-101 objective of making it easy for patients to do business with you.

The average practice can easily qualify for incentives under new performance-based payment systems. First-year flexibilities mean physicians can stave off initial losses and earn incentive and bonus payments under relaxed requirements. There won’t be a better opportunity to implement a strategy for future success under MACRA. Care providers who proactively engage with new payment and care delivery models, and cultivate the right partnerships and expertise, will unequivocally have more opportunity in the future.

The next piece in this series will touch on best practices for clinical success in the march towards MACRA.